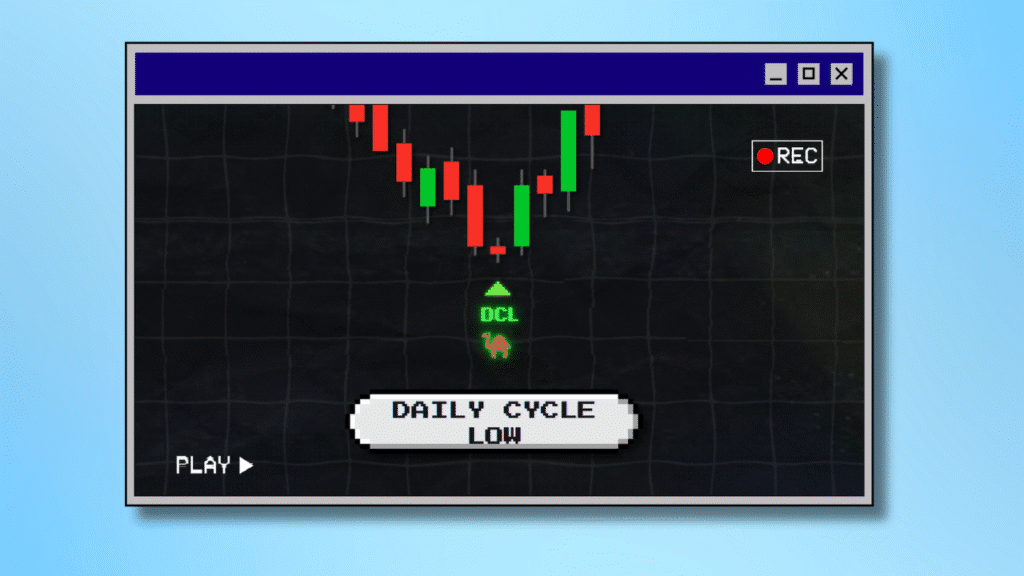

Understanding Daily Cycle Lows

Daily Cycle Lows The Secret to Timed Entries The Daily Cycle Low (DCL) is one of the most actionable points in short-term trading. This is where the market “resets” after a pullback and often begins a new move up — if it holds. The CF Cycle Trading Indicator plots these DCLs using a combination of […]

What is Cycle Trading?

What is Cycle Trading? An Introduction to Market Rhythm Cycle trading is based on the idea that markets don’t move randomly — they move in cycles. These cycles form natural lows (bottoms) and highs (tops) over time, which traders can track to improve timing and reduce risk. At Camel Finance, we focus on Daily, Weekly, […]

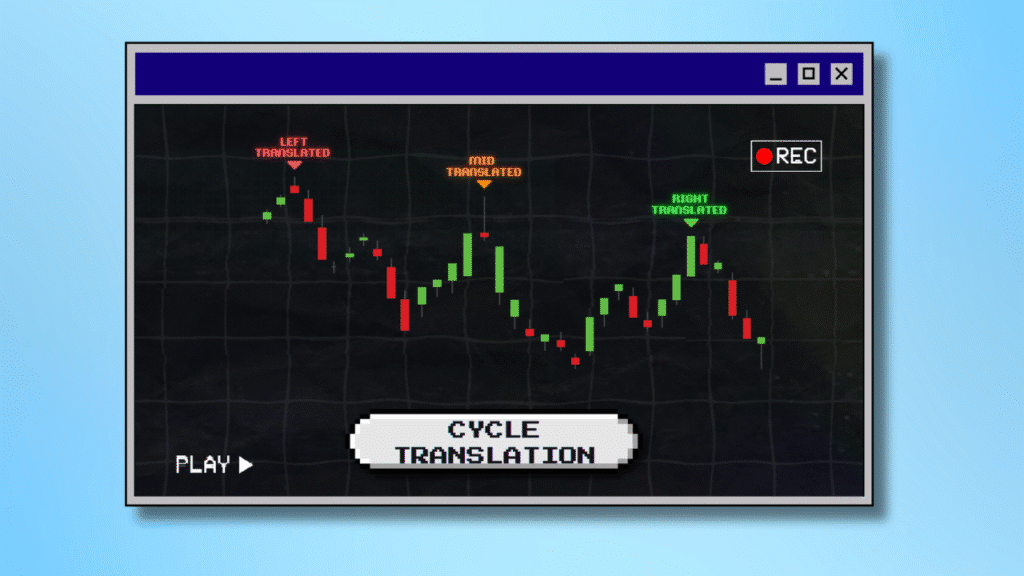

What is Cycle Translation?

Cycle Translations Left, Mid, or Right? Know the Bias Not all cycles are equal — some are bullish, some are bearish. The position of the cycle top tells you a lot: Right-Translated = Bullish (top forms late in the cycle) Mid-Translated = Neutral (top near the middle) Left-Translated = Bearish (top forms early, then drops) […]

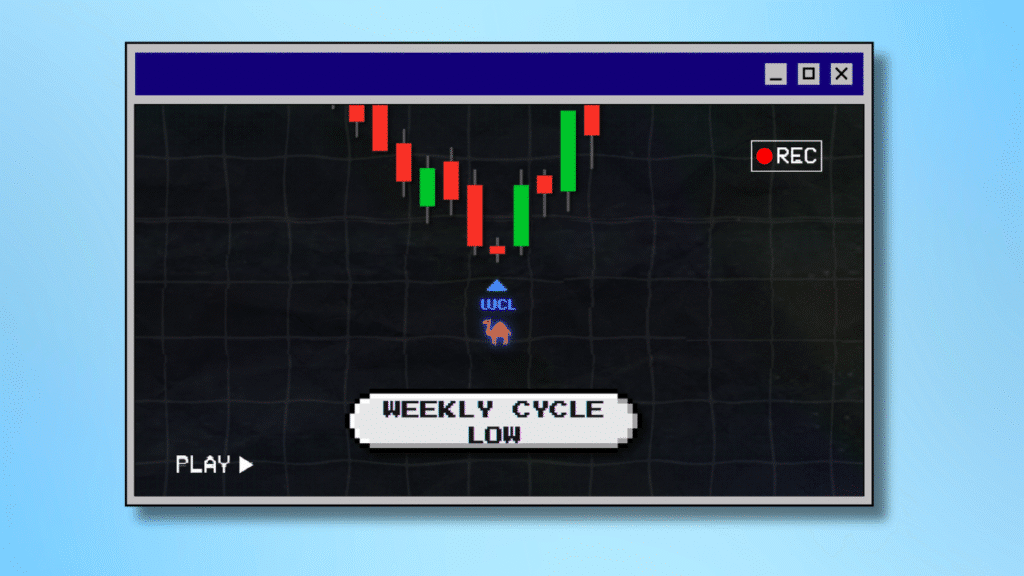

Understanding Weekly Cycle Lows

Weekly Cycle Lows Ideal Timing for Swing Traders While Daily Cycle Lows are great for short trades, Weekly Cycle Lows (WCLs) are better for holding positions over multiple weeks. WCLs show up as blue bands and blue icons on the chart. They represent a larger timeframe reset — and often come near strong support or […]

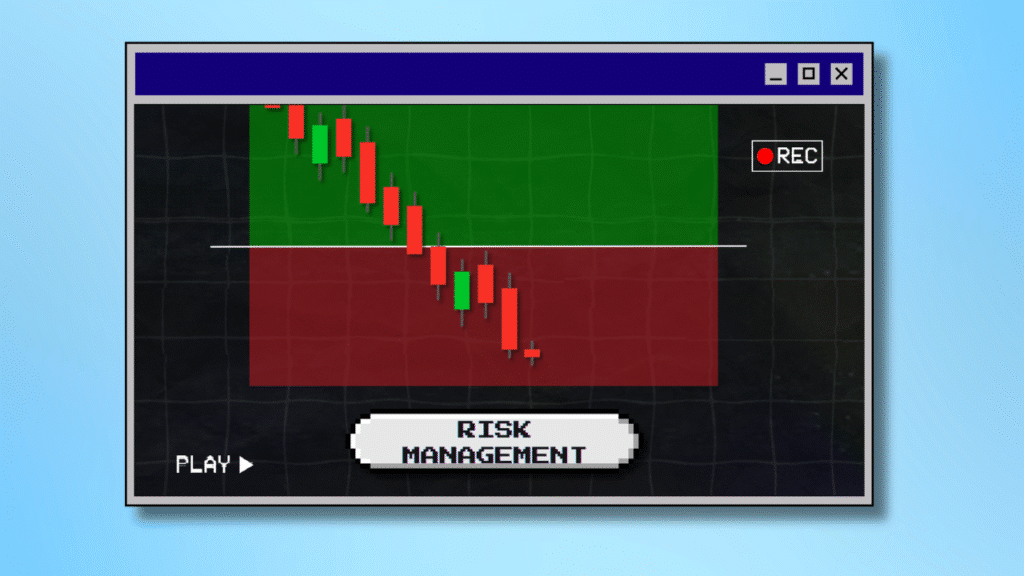

How Cycle Trading Helps You Manage Risk

How Cycle Trading Helps You Manage Risk Understanding Risk Management Cycle analysis isn’t just about catching the bottom — it’s about avoiding the middle. By focusing on Daily and Weekly Cycle Lows, traders can: Avoid chasing during emotional rallies. Enter when risk/reward is best. Use structure (like confirmation candles) to place tight stop-losses. The CF […]